Customer Centricity in Pharma and Healthcare: 5 Key Take outs

Customer centricity isn’t a new topic, but has the healthcare and pharmaceutical industry truly got a handle on it?

We had a really interesting discussion on this in our recent webinar and were fortunate to have Lucy Mitchell from Jazz Pharmaceuticals join us to give her perspective.

It’s not too late to listen in and you can register to watch on demand here.

But if you’re in the pre-Christmas rush and don’t have the time, we have summarized some of the key takeouts below.

How is the pharma landscape evolving and what does that mean?

1 / The complex customer

Unlike other industries, the pharmaceutical sector faces a unique challenge in identifying their primary customer. Is it the patient, healthcare providers, regulators, pharmacists, or key opinion leaders – or maybe all of them? This complexity requires a multi-faceted approach to customer centricity or at least having a POV on what makes the most sense for your business.

We have seen a shift over recent years from patient centricity being the buzz word through to today, where there is a recognition of the need for a broader focus – or at least a more purposeful approach balancing what makes the most sense for the specific organization, therapy area or brand.

“In order to have that true customer centricity, we first need to define what we mean by the customer, and the customer that each of our initiatives is focused on. It’s then really essential that it is owned by the whole company, allowing us to focus on a joined-up way of engaging with them and having those customers truly at heart….

We don’t want to just be good at doing lots of things to do with customer engagement – we need to be really good at the things that make the difference.”

– Lucy Mitchell, Jazz Pharmaceuticals [extract from webinar]

2 / Product evolution and stretch

Pharmaceuticals have made significant strides from simple ‘pill’ type medications to more complex and individualized interactions – think biologics or CAR-T or even digital monitoring of conditions. It’s no longer enough to rely on ‘blockbuster’ molecules. In an increasingly competitive market there is more and more emphasis on the ‘experience’.

Take the process of coming off a chronic treatment or even the first impressions of a new device when you have the ‘unboxing’ experience. These seemingly less important micro experiences as part of the broader brand journey matter more and more.

3 / A sudden push on pace

The pharmaceutical industry, traditionally slower to adapt, is now compelled to keep pace with rapid external changes. Global pandemics, technological advancements, and evolving treatment approaches are forcing companies to rethink their strategies. Pharma companies can no longer hide behind the excuse that the rules and regulations make it harder to adapt and evolve.

There are cultural shifts that need to happen. Pharma companies have been quite good at “installation” – putting the structure and systems in place, but often less so at “implementation”, i.e. bringing hearts and minds along to change the ways of working.

4 / Different expectations

We know that culturally the focus on health is going to be very different for the Gen Z and Gen Alpha etc… They are going to expect the same level of convenience and innovation that we know from digitally mature industries like banking, consumer goods etc.

In addition to this, there is a need to think more holistically and consider the broader patient needs eg impact on mental health. We need to be better at predicting change and cultural shifts to stay relevant beyond the condition or the treatment.

5 / So who are the standout customer centric pharma companies?

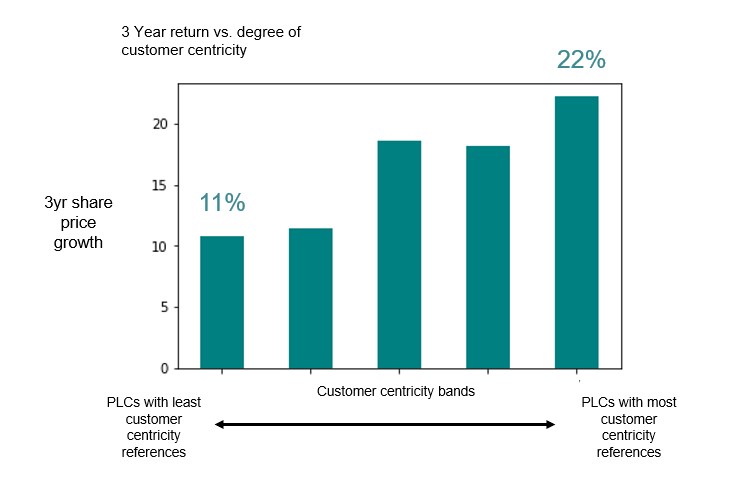

We analysed annual reports of all the UK’s largest listed companies on the FTSE 100 and 250 and what we found was that more customer centric companies outperformed the least customer centric companies by 10pp in terms of market capitalisation growth over 3 years.

Unfortunately, it’s difficult to break out and look at pharmaceutical companies separately – the sample becomes too small, and pharma share prices can sometimes have something of a “hits-driven” nature making comparisons harder.

There is an interesting report from DT Consulting that looks at the state of customer centricity in the pharma industry. There are few interesting takeouts. Namely that pharma companies don’t really excel when it comes to the customer experience and in fact none of them are leading in this space. Where there is some small areas of differentiation eg Lilly, NovoNordisk and Roche, this is driven by factors such as trust, access to information and non-digital interactions.

Let’s take Roche – A great example where they have moved away from sales reps and now consider their customer facing team as customer journey partners instead, signalling a clear move from being product focused to experience focused.

STRAT7 Path – a framework for assessing customer-centric maturity

There is so much to discuss on this topic and in the webinar, we got a little carried away and didn’t spend much time talking about our STRAT7 Path model for navigating change.

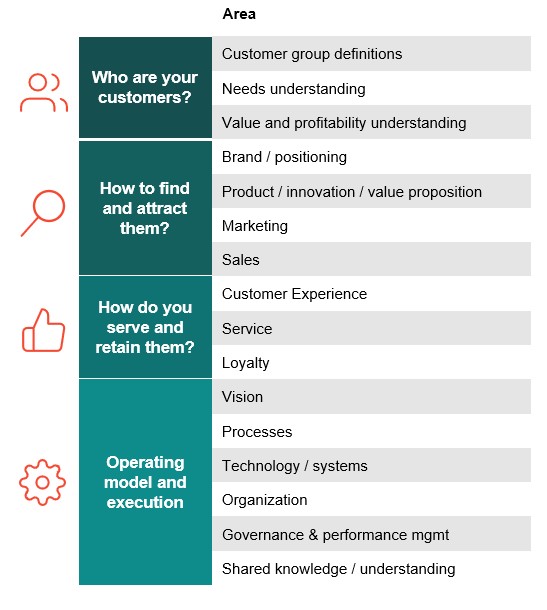

Our model is a structured approach to navigating the change journey in an organization and assessing customer-centric maturity. This model involves answering some of the questions below, allowing us to create a granular understanding of how an organization stacks up:

With STRAT7 Path, we can determine an organisation’s maturity across those dimensions, benchmark against category leaders, and start setting out the ambition and roadmap of actions to get there – taking customer centricity from an abstract concept to a tangible and impactful outcome.

Interested? Get in touch to find out more.